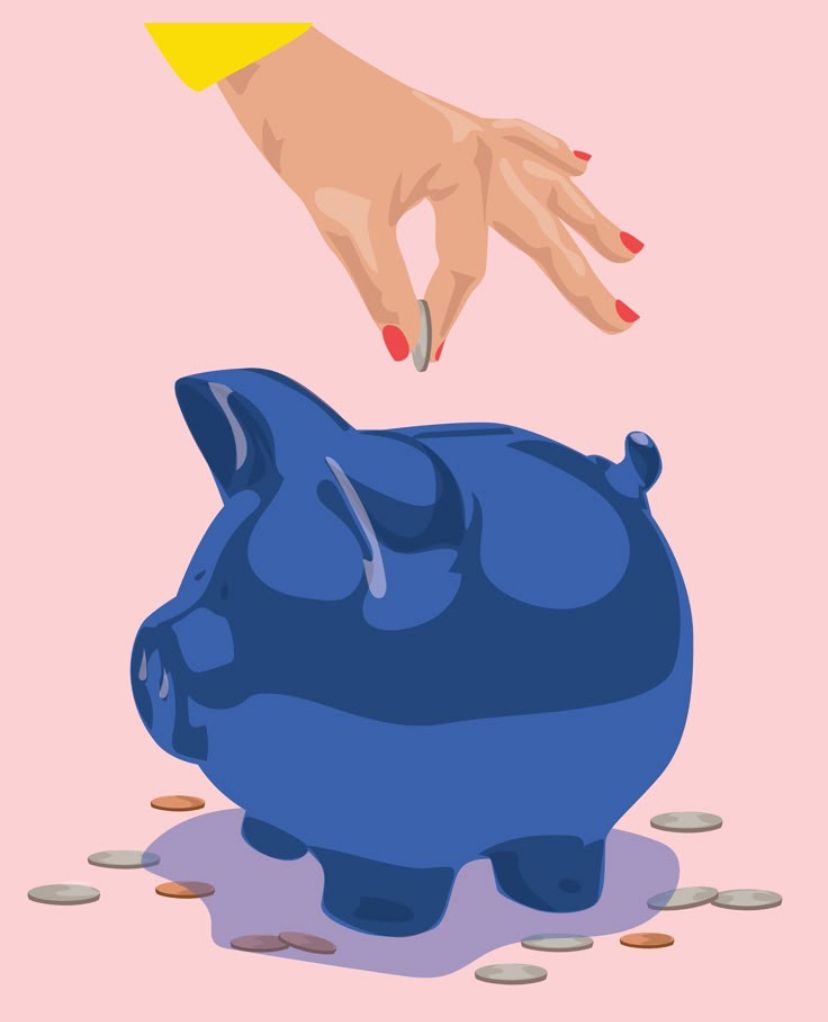

The Art of Intentional Saving: A Guide to Stashing Your Coins.

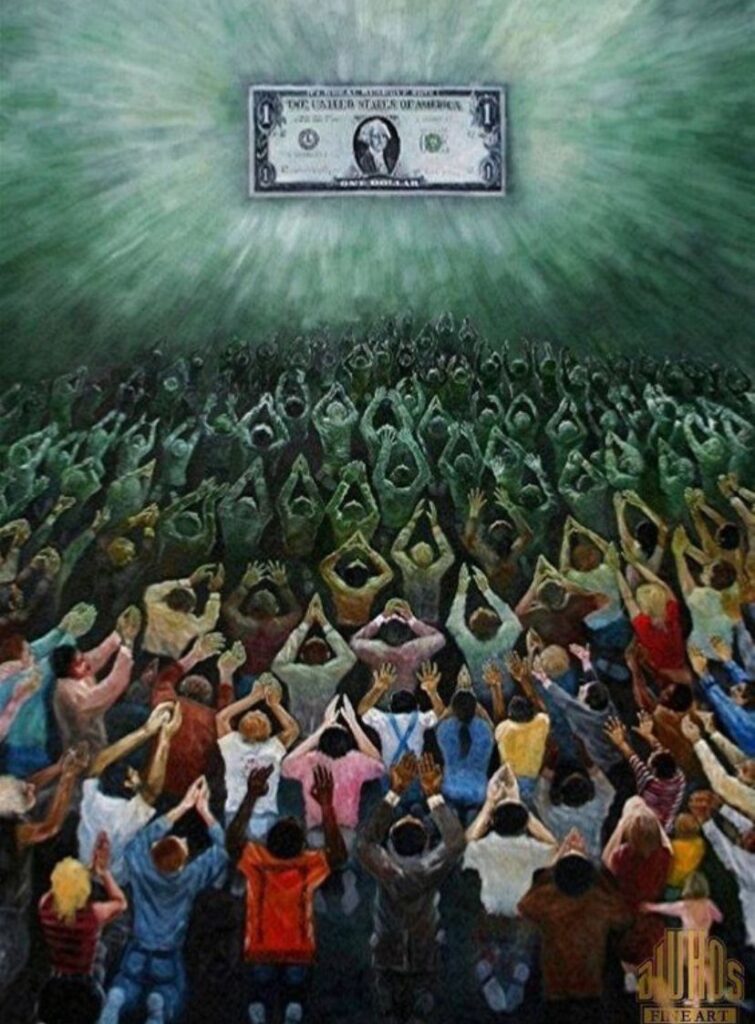

Saving money has a reputation for being tedious as if every dollar you put away means missing out on something fun. But what if saving didn’t feel like punishment? What if, instead of feeling deprived, you found ways to enjoy the process? Enter intentional saving the mindful practice of making decisions that allow you to enjoy life now while preparing for the future. It’s not about being cheap, but about being smart with your spending. With a few simple tips and a light-hearted approach, you’ll be stashing your cash without feeling like you’re sacrificing the joy of today.

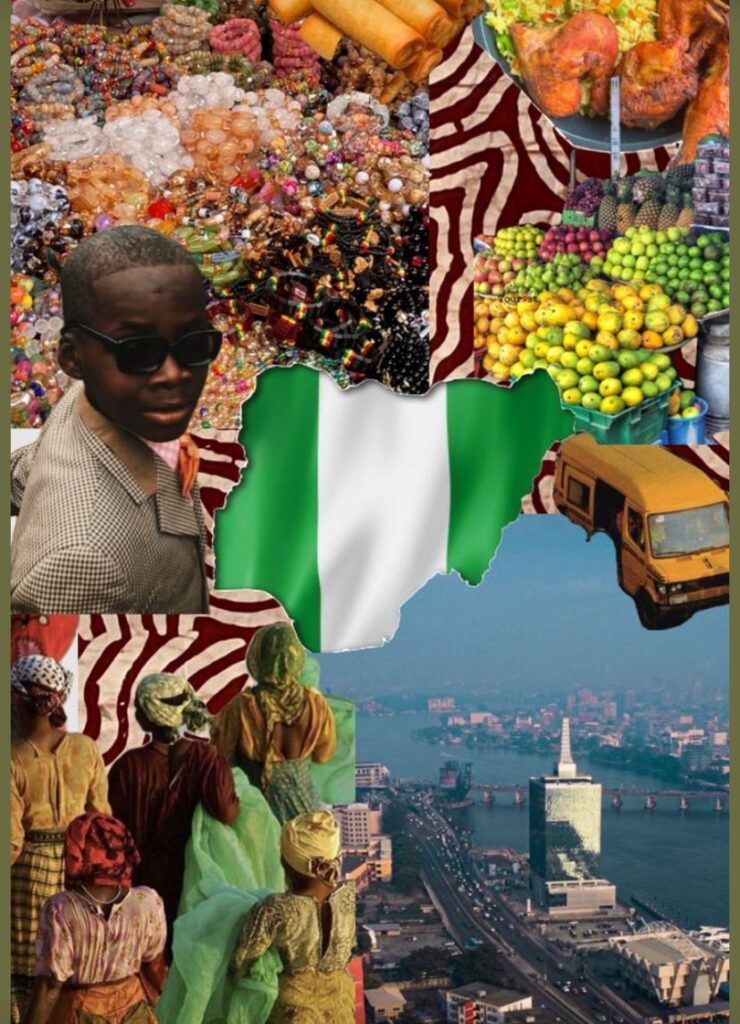

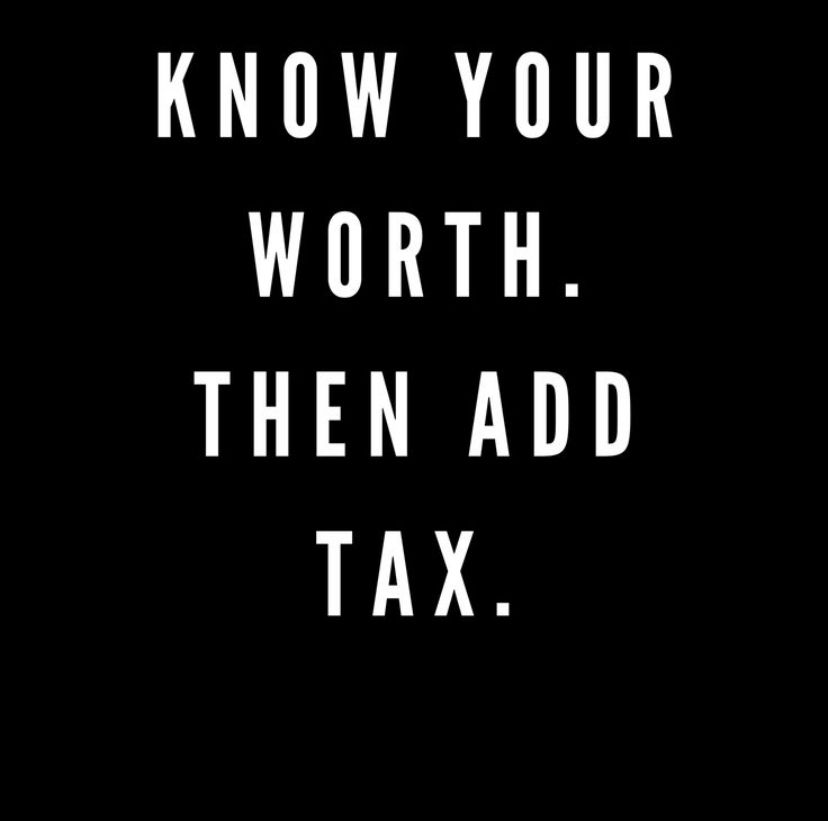

Step 1: Know Your Financial Goals (But Keep It Fun!) The first step in being an intentional saver is having clear financial goals. Whether it’s saving for a rainy day, a dream vacation, or early retirement, having something to look forward to makes saving feel rewarding. Don’t just set vague goals like “save more” get specific. Instead, think: “Save 5 million naira for a new car to ride around the city” or “Put aside 2.5 million for a vacation.” Now you’ve turned your savings into something exciting!

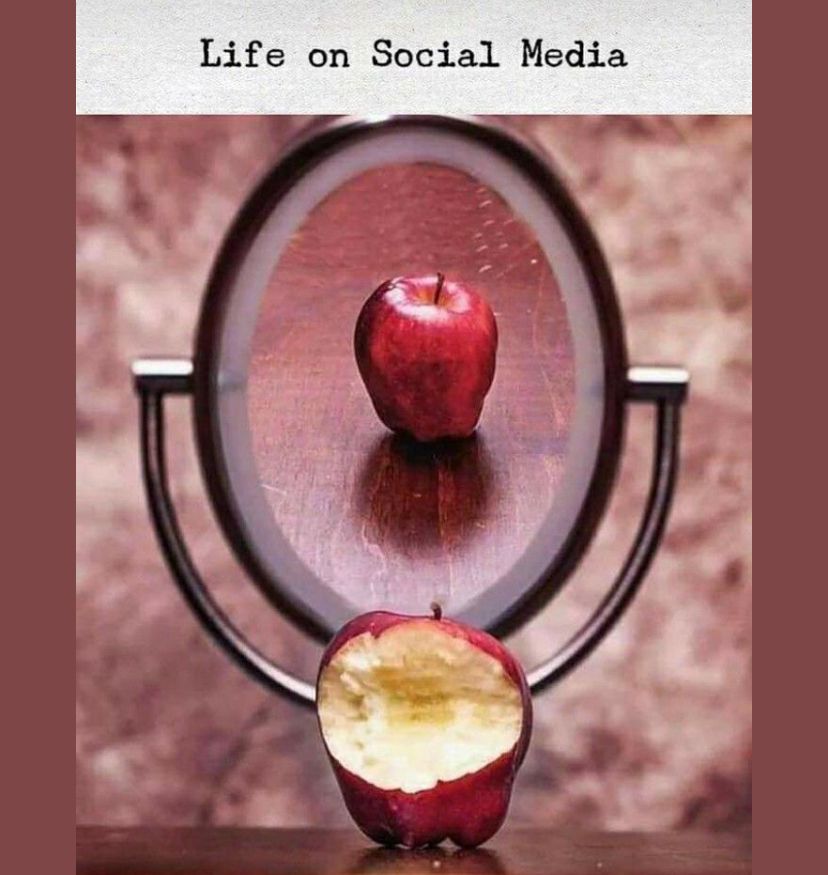

Step 2: Track Your Spending (Without Becoming a Spreadsheet Zombie) You don’t need to be a math whiz or track every cent religiously. The goal is simply to be aware of where your money goes. Start small: track your spending for a week and see where your money leaks those sneaky expenses you forget about (yes, that extra iced coffee counts!). Once you know where your money is going, you can decide what’s worth keeping and where you can cut back.

Step 3: Budget for Fun (Because Life’s Too Short to Be Miserable) People often think budgeting means cutting out all the fun stuff, but that’s not true. Budgeting for fun is essential to avoid burnout. Set aside money for things that make you happy whether it’s dinners out, a Netflix subscription, or a shopping spree now and then. The key is moderation. Be intentional with your splurges so you can enjoy them guilt-free, knowing you’re not going overboard.

Step 4: Embrace the Power of “No” (With a Smile) Saving intentionally means sometimes saying “no” to the things that aren’t aligned with your goals. But saying “no” doesn’t have to feel like a drag it’s empowering! Every time you pass on an impulse buy, you’re saying yes to something better down the line. Next time you’re tempted by the latest gadget or sale, take a moment to remind yourself why you’re saving. Saying “no” now means a bigger “yes” to your future self.

Step 5: Automate Your Savings (So You Can Forget About It) Let’s face it saving can be hard when you have to manually move money into a savings account every month. Automating your savings is the secret weapon of intentional savers. Set up an automatic transfer from your checking account to your savings account each month. This way, you don’t have to think about it, and your money grows in the background while you focus on other things (like enjoying life!).

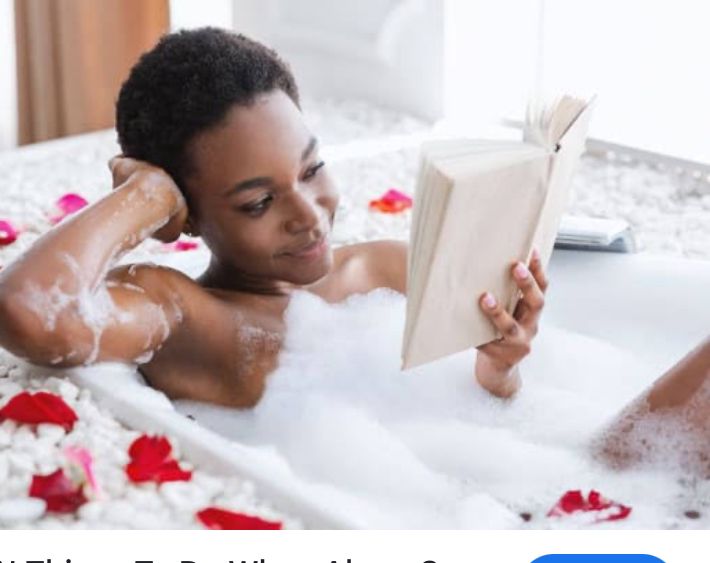

Step 6: Celebrate Your Wins (Even the Small Ones) Saving intentionally isn’t all about delayed gratification it’s about celebrating progress, no matter how small. Set milestones for yourself and reward your efforts. Did you reach your goal of saving #200,000 this month? Treat yourself to a small reward, like a nice coffee or a new book. These little celebrations keep you motivated and make the saving process feel more enjoyable.

Intentional saving isn’t about denying yourself life’s pleasures it’s about creating a balance between enjoying today and securing tomorrow. By setting clear goals, tracking your spending, and embracing smart budgeting, you’ll find that saving can be fun. The key is to be mindful and to find joy in the process. After all, every money saved brings you closer to your dreams. So go ahead, stash those coins your future self will thank you!

By Edima Columbus

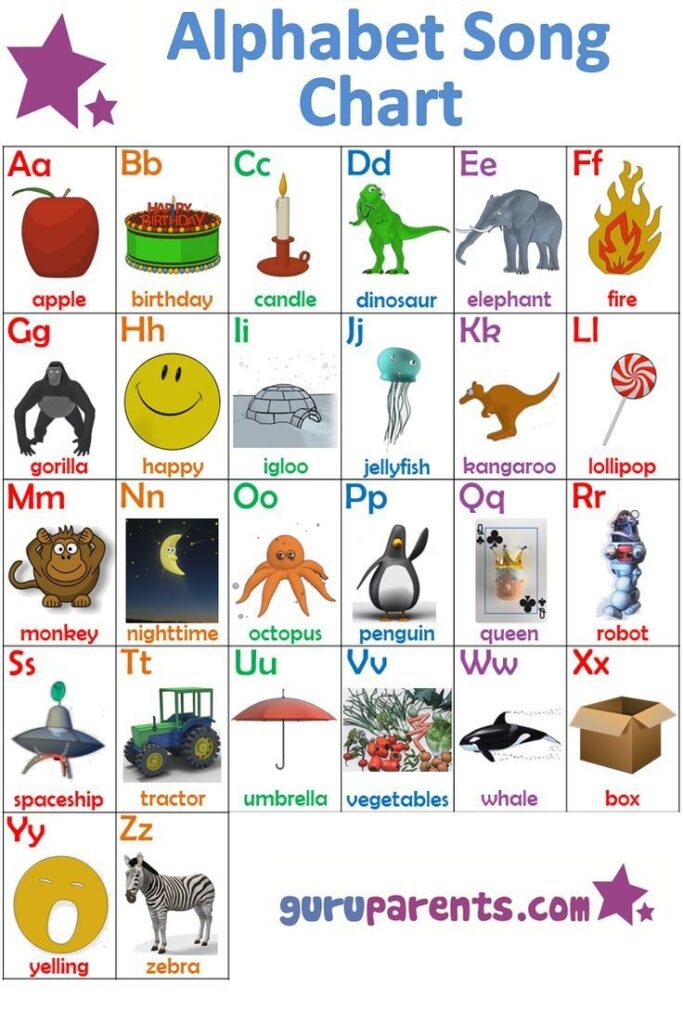

English

English