The Concept of Loud Budgeting: Making Your Finances Heard.

Budgeting is often considered a quiet, behind-the-scenes activity. However, the concept of “loud budgeting” flips this idea on its head, encouraging individuals to make their financial goals and priorities heard. Loud budgeting is about being proactive, transparent, and assertive with your financial planning, ensuring that your money works for you in the most effective way possible.

- Setting Clear Goals:

Loud budgeting starts with setting clear financial goals. Whether it’s saving for a down payment on a house, paying off student loans, or building an emergency fund, clearly define your objectives. - Being Vocal About Your Priorities:

Don’t be afraid to vocalize your financial priorities to yourself, your partner, or your family. By openly discussing your financial goals, you can ensure that everyone is on the same page and working towards the same objectives. - Tracking Your Spending Out Loud:

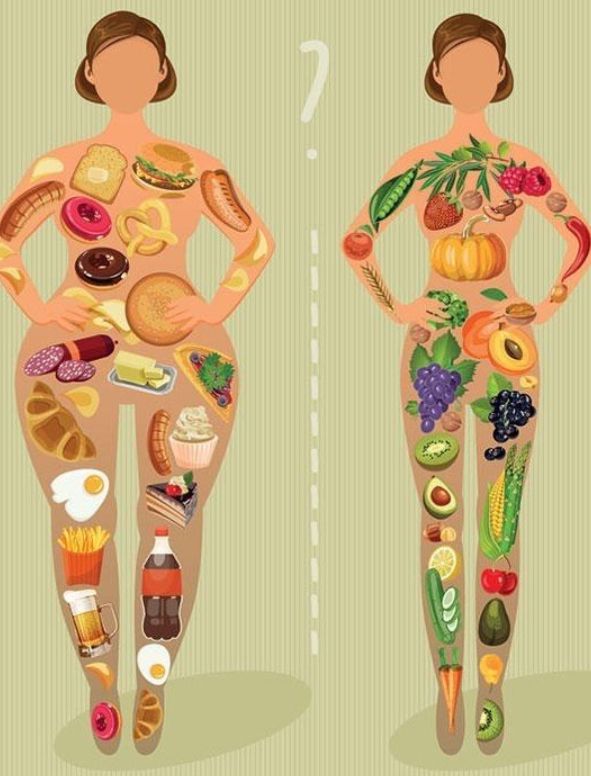

Keep track of your spending and expenses out loud, whether it’s through budgeting apps, spreadsheets, or regular check-ins with your financial advisor. This transparency helps you stay accountable and ensures that you’re staying on track with your budget. - Making Informed Financial Decisions:

Loud budgeting also means being proactive and informed about your financial decisions. Whether it’s researching investment options, comparing interest rates, or renegotiating bills, take an active role in managing your money. - Advocating for Yourself:

Don’t be afraid to advocate for yourself when it comes to your finances. Whether it’s negotiating a higher salary, asking for a lower interest rate on a loan, or challenging unnecessary fees, speaking up can help you save money and reach your financial goals faster. - Celebrating Financial Wins:

Finally, loud budgeting is about celebrating your financial wins, no matter how small. Whether it’s reaching a savings milestone, paying off a debt, or sticking to your budget for a month, take the time to acknowledge and celebrate your achievements.

By embracing the concept of loud budgeting, you can take control of your finances, make your priorities heard, and work towards a more secure financial future. So go ahead, speak up, and let your financial goals be heard loud and clear!

English

English