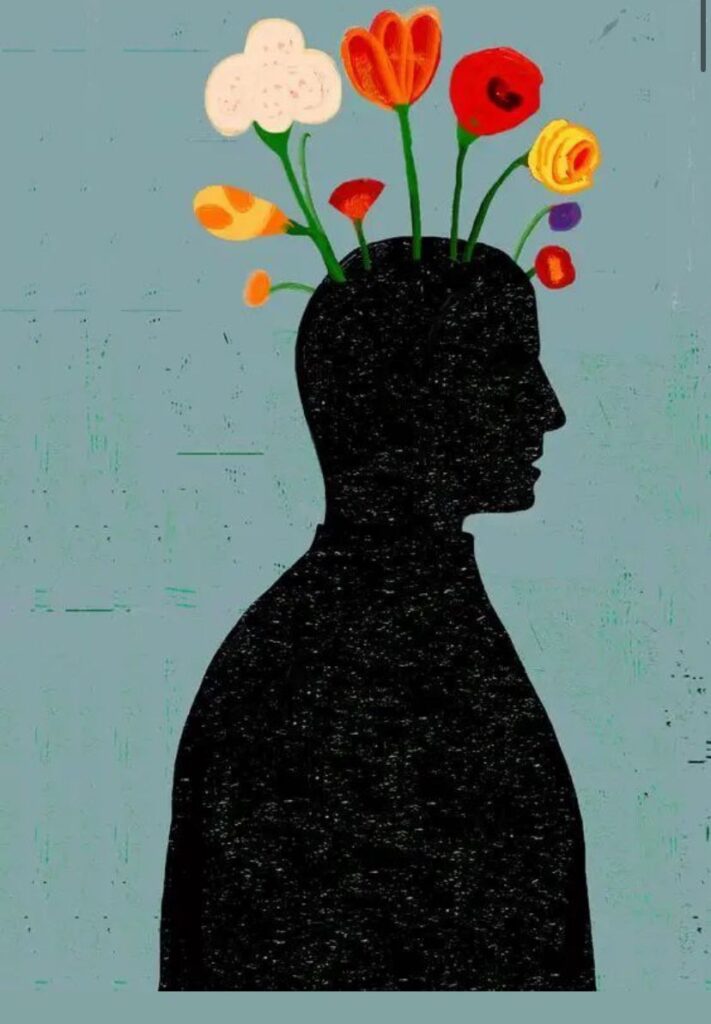

Cultivating a Saving Mindset: Building Financial Security One Step at a Time.

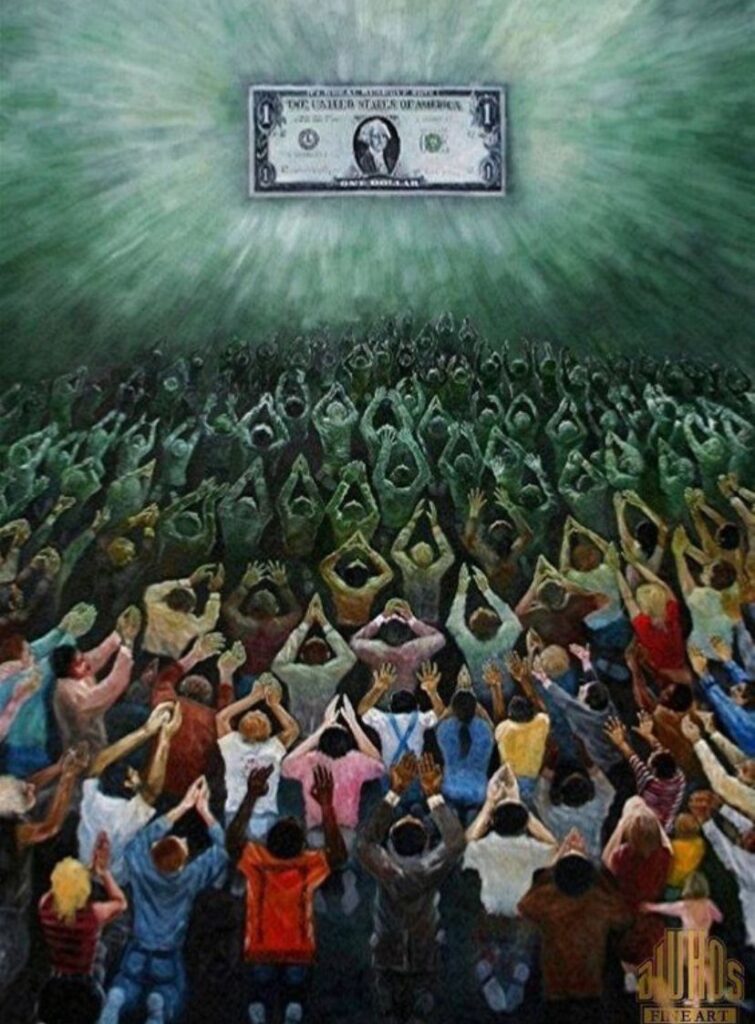

In today’s fast-paced world, where consumerism often tempts us at every turn, cultivating a saving mindset can be a powerful tool for achieving financial stability and peace of mind. Adopting this mindset isn’t just about pinching pennies; it’s about making deliberate choices that align with your long-term goals and values. Here’s how you can start cultivating a saving mindset:

- Define Your Why

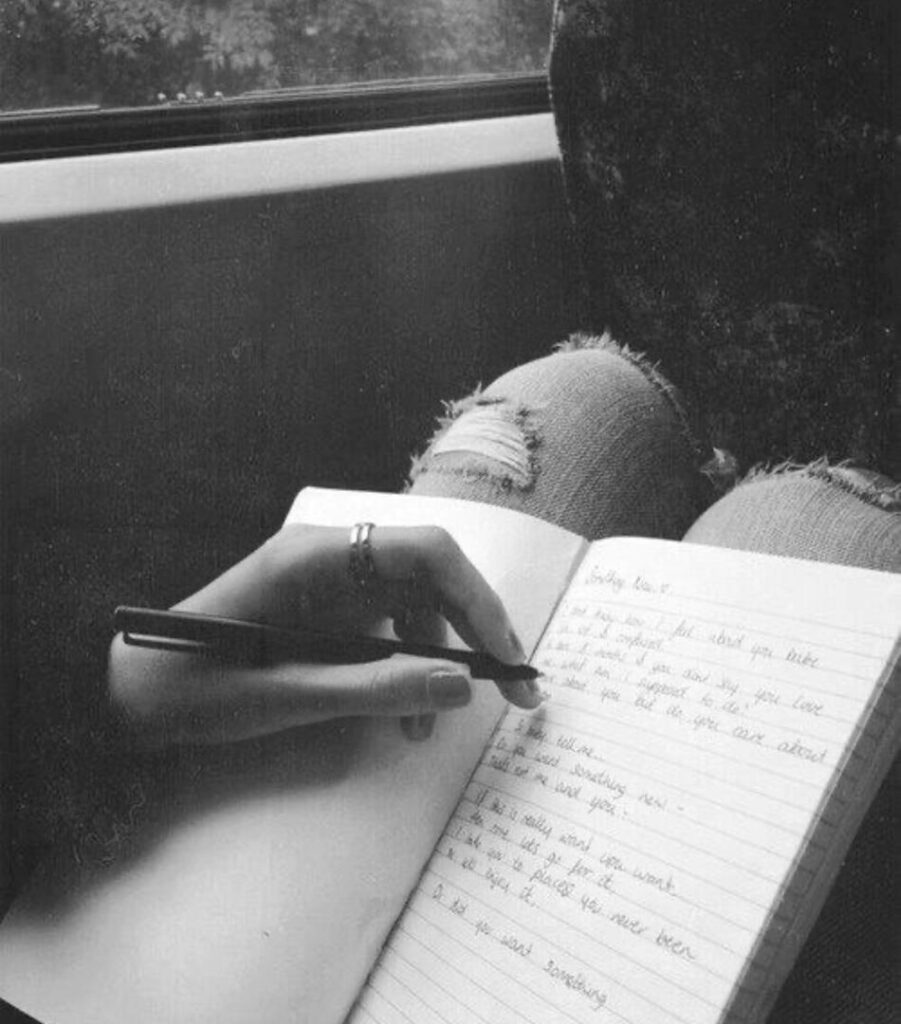

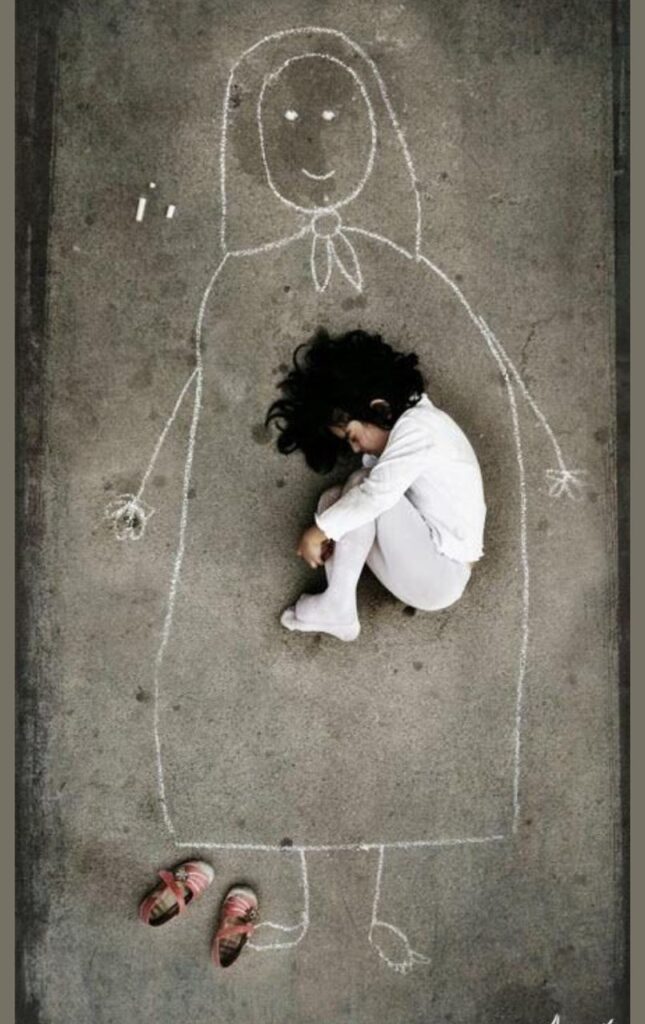

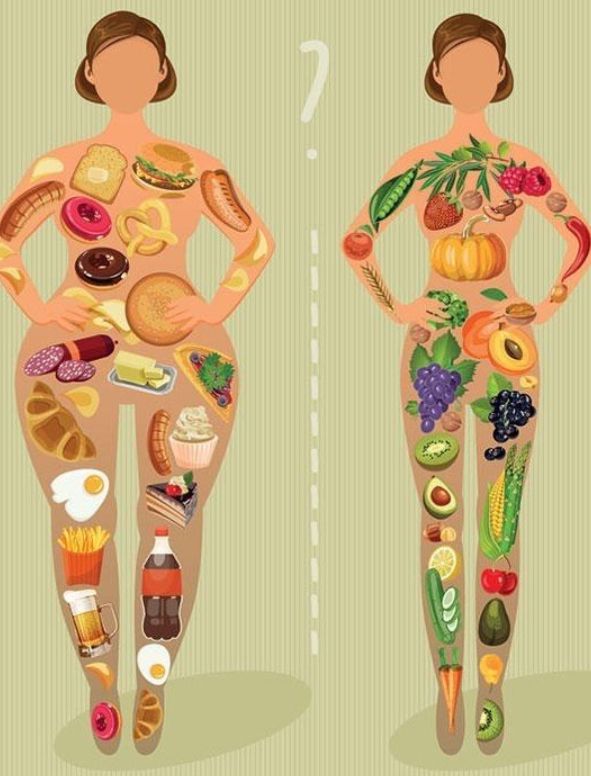

Before diving into the mechanics of saving, take a moment to reflect on your reasons for wanting to save. Are you aiming for a down payment on a house, planning for retirement, or building an emergency fund? Understanding your motivations will help you stay committed when temptations to spend arise. - Shift from Consumption to Purpose

In a culture that often equates spending with happiness, challenge yourself to redefine what brings you true satisfaction. Shift your focus from fleeting purchases to meaningful experiences and long-term goals. Recognize that every dollar saved is a step closer to financial freedom and security. - Create a Realistic Budget

A budget is the foundation of any successful saving plan. Track your income and expenses meticulously to understand where your money goes each month. Identify areas where you can trim unnecessary expenses and allocate those savings towards your financial goals. - Set Achievable Goals

Break down your savings goals into smaller, achievable milestones. Whether it’s setting aside a certain percentage of your income each month or saving a specific amount by a certain date, having clear objectives will keep you motivated and accountable. - Automate Your Savings

Make saving effortless by automating contributions to your savings or investment accounts. Set up automatic transfers on payday so that a portion of your income goes directly towards your savings goals before you have a chance to spend it. - Educate Yourself

Knowledge is power when it comes to managing your finances. Take the time to educate yourself about personal finance topics such as investing, debt management, and financial planning. The more informed you are, the better equipped you’ll be to make smart financial decisions.

Adopting a saving mindset is not just about securing your financial future; it’s about empowering yourself to live a life aligned with your values and aspirations. By making intentional choices, setting clear goals, and staying disciplined, you can cultivate habits that lead to lasting financial health and well-being. Remember, every small step you take today brings you closer to a more secure and fulfilling tomorrow.

By Edima Columbus

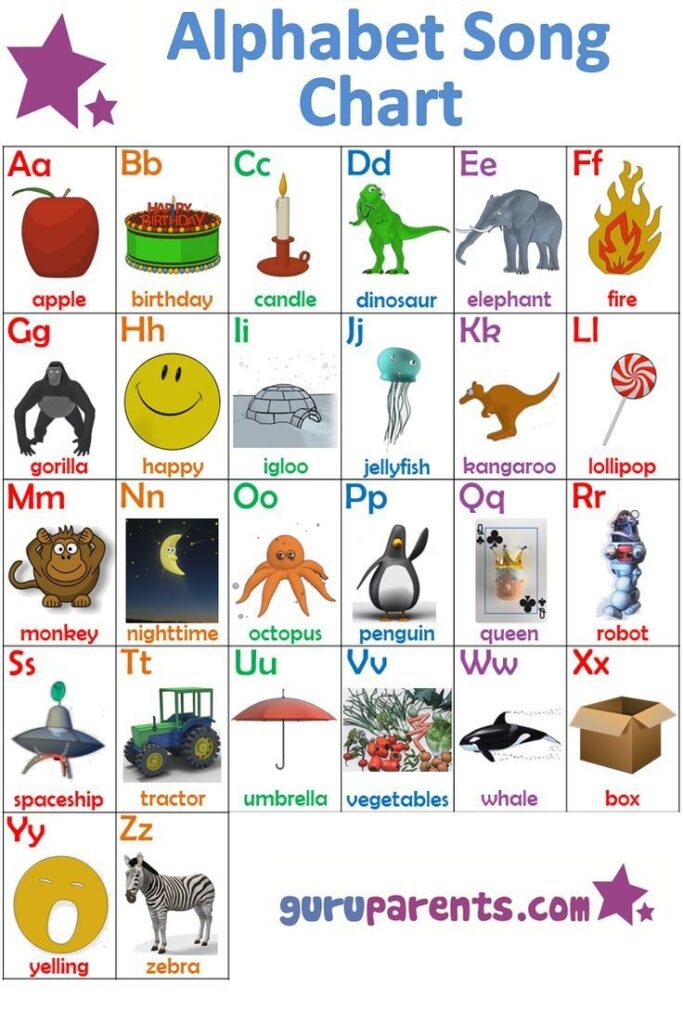

English

English